Adjusted gross income calculator hourly

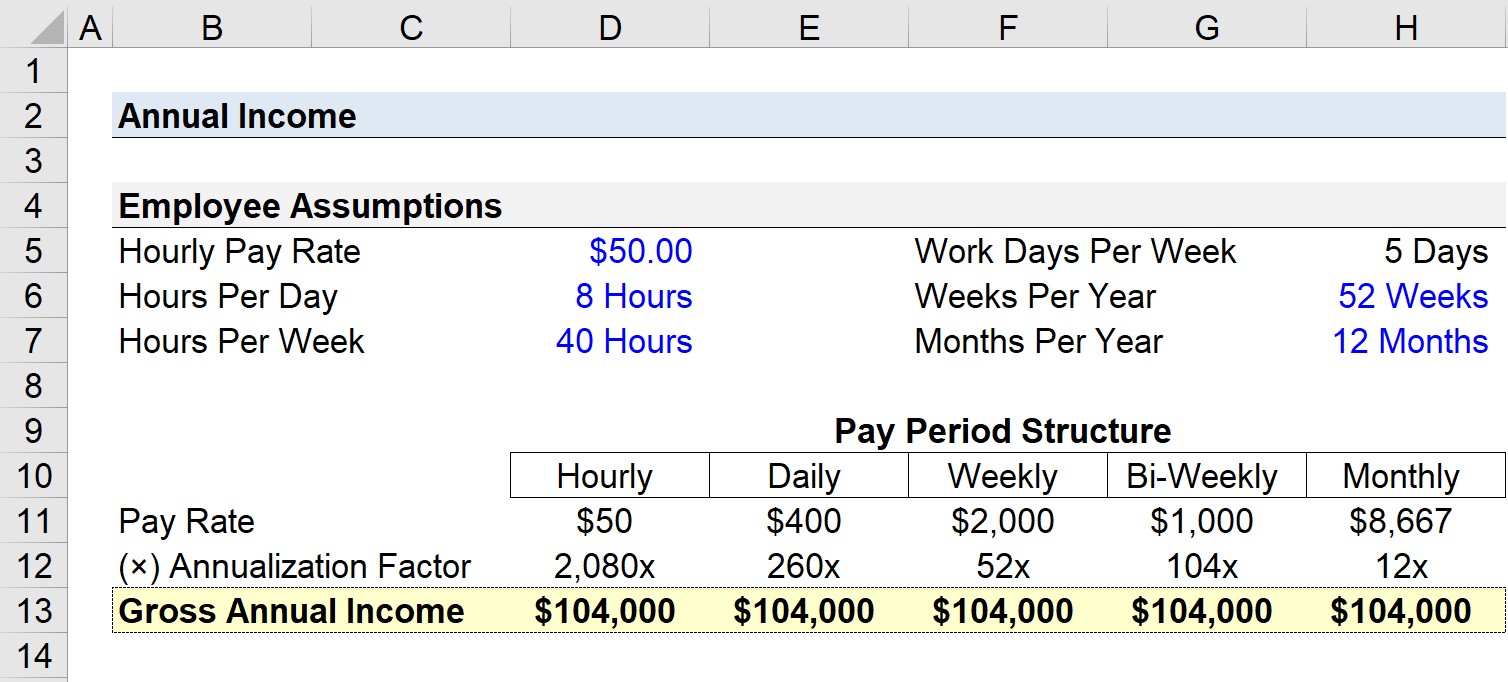

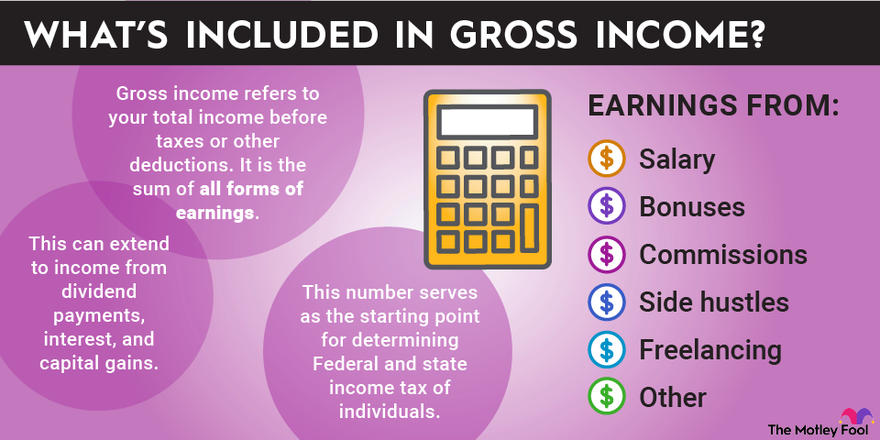

For instance if a grocery store hires cashiers for an hourly rate of 1500 per hour on a full-time schedule of 40 hours a week you can calculate the annual pre-tax salary by multiplying the hourly rate by 40. Individual gross income includes wages tips dividends alimony pension and interest.

Employee Cost Calculator Updated 2022 Employee Cost Calculation

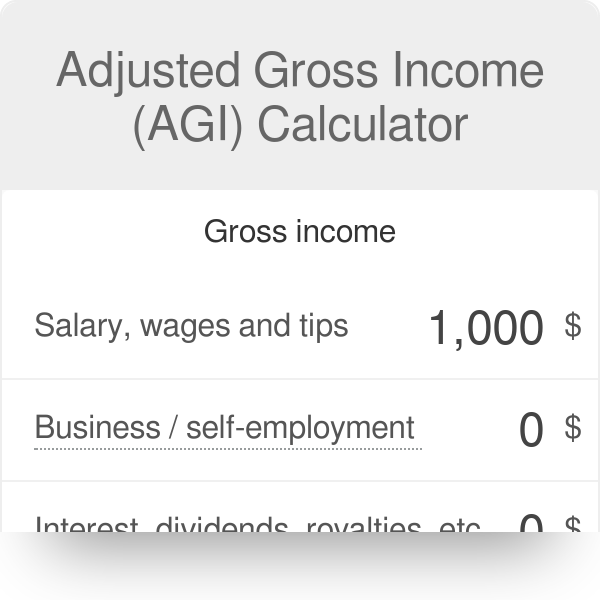

For tax filing purposes this would be the same as your Adjusted Gross Income however the calculator is unable to take lower capital gains taxes into consideration.

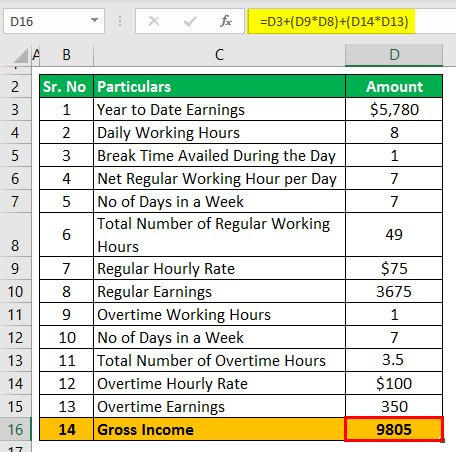

. If youre an hourly worker the gross income on a pay stub is your hourly wage multiplied by hours worked. 2022 W-4 Help for Sections 2 3 and 4. Gross annual income is the amount of money a person earns in one year before taxes.

Hourly Gross Salary per Pay Period. What is a 53k after tax. Then include any overtime pay.

2022 Income Tax Calculator Québec. Gross wages are also on the W-2 forms received from employers at tax time. See the Bigger Picture.

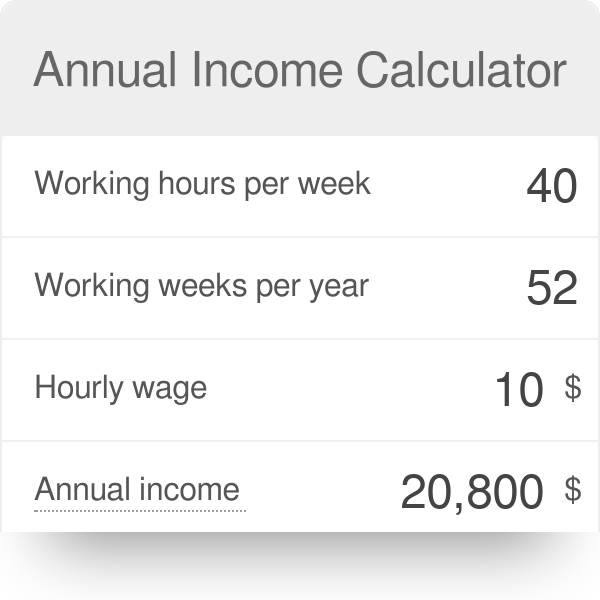

Number of Children under age 17. If youre paid a salary thats your gross income. This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations.

ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. This is your total taxable income for the year after deductions for retirement contributions such as 401ks IRAs etc. Companies can back a salary into an hourly wage.

There are income sources that are not included in gross income for tax purposes. 4183300 net salary is 5300000 gross salary. Salary Calculator For Permanent Employees.

Next you will need to calculate overtime for hourly workers and some salaried workers. Free Federal and North Carolina Paycheck Withholding Calculator. If an employees hourly rate is 12 and they worked 38 hours in the pay period the employees gross pay for that paycheck is 45600 12 x 38.

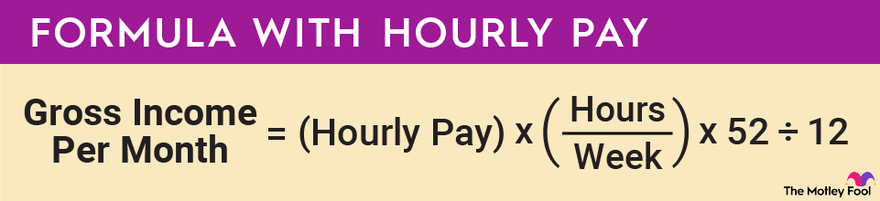

Then multiply the product by the number of weeks in a year 52. 2022 free Québec income tax calculator to quickly estimate your provincial taxes. Your Adjusted Income is over 240000 and your Threshold Income over 200000.

53000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations. These are expenditures on eligible products services or contributions that may be subtracted from taxable income including qualified mortgage interest state and local income tax plus either property or sales taxes up to 10000 charitable donations medical and dental expenses over 10 of adjusted gross income etc. How to calculate Federal Tax based on your Annual Income.

The 2021 Tax Calculator uses the 2021 Federal Tax Tables and 2021 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. How Gross Income Works. Income to be taxed as supplemental income.

Taxable Benefits and Cash Allowance. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. After subtracting above-the-line tax deductions the result is adjusted gross income AGI.

All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2022. Bonuses also count as gross income.

3 Ways To Calculate Your Hourly Rate Wikihow

4 Ways To Calculate Annual Salary Wikihow

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Monthly Gross Income Calculator Freeandclear

Hourly Paycheck Calculator Step By Step With Examples

Annual Income Formula And Gross Earnings Calculator Excel Template

Agi Calculator Adjusted Gross Income Calculator

How To Calculate Gross Income Per Month

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Annual Income Calculator

What Is Adjusted Gross Income And How To Calculate It Hourly Inc

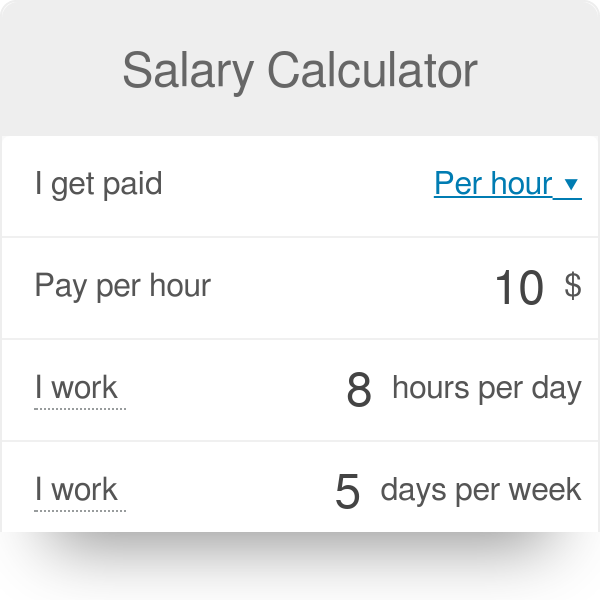

Salary Calculator

Lkhjrk5ohosmhm

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro Adjusted Gross Income Income Federal Income Tax

How To Calculate Gross Income Per Month

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

How To Calculate Adjusted Gross Income With An Hourly Wage